|

Specializing in the legal implementation of the "cash discount program" in Ma Please note: For restaurants not interested in the cash discount program (traditional processing) we offer FREE processing equipment. Pos systems, printers, hand-held tablets etc. Monthly software fees are the lowest in the industry! Important: Other processors offering free equipment charge extremely high monthly software fees to offset their "free" equipment. We also offer the lowest transaction rates in the industry. There are NO statement fees, NO pci fees, No annual fees or any "junk" or "B.S." fees! |

|

Eliminate

ALL Your Credit Card

Processing Fees With

Cash

Discount Program!

© 2021

William J. Mullen / Copyright Pending

The animated product tour videos

on this website are original content and the sole property of William J.

Mullen. As such they are protected by the United States federal and international

copyright laws. It is illegal to copy or reproduce any portion of these

videos. Violations are subject to statutory damages and attorney fees.

CASH DISCOUNT TUTORIAL VIDEO

Click The Left Arrow to Play/Stop

**********************

Jan.

3, 2020

Commonwealth

of Massachusetts

Office

of Business Regulation / Division of Banks

Approves

the Cash Discount Program For

One Of Massachusetts

Largest, Oldest And Best Known

NEW CAR

AUTO DEALER

*This

opens the door for all retail businesses to implement the

Cash Discount Program!

YOU WON'T LOSE A SINGLE CUSTOMER!

AUTO REPAIR & OTHERS

TESTIMONIAL VIDEO

Click The Left Arrow to Play/Stop

************************

THIS SUMS IT UP ENTIRELY

!

Today most merchants have given up trying to decipher their monthly processing

statement or even bothering to look at it. Accepting their constantly increasing

charges as just the cost of doing business is the common mind-set.

The “root” of this problem actually stems from the fact that accepting bank

cards is not a convenience for merchants,

yet they are the ones that are forced to pay for all the conveniences that

benefit ONLY THE CUSTOMER!

CONSIDER THESE FACTS:

The customer is the one

that is receiving all the benefits and conveniences when paying

with their bank card.

-

The convenience of not having to carry cash

-

The convenience of making monthly installments on purchases they can’t

currently afford to pay in full

-

The convenience of fraud protection for unauthorized purchases

-

The convenience of initiating a “charge-back”

IF

they’re not satisfied

-

The BENEFIT of 2% CASH-BACK when using their REWARDS CARD

CONVENIENCE FOR A BUSINESS

OWNER?

THERE ARE NONE

!

And…………..In case you are not aware of it,

YOU

the business owner are paying for the customer’s rewards “cash-back”, airline

miles or other benefits which gets added

to your regular processing fee. Today nearly 90% of all credit card

purchases are being made with a REWARDS CARD costing you on the average

5% of your net profit on the sale.

Worse still there is a good chance your existing processor has been taking

advantage of a long relationship by "padding"

your monthly billing statement with unnecessary

"junk fees" that have cost you many $$ over the years!

A NEW LAW NOW ALLOWS YOU RELIEF!

THE MASSASCHUSETTS DIVISION OF BANKS HAS DETERMINED THAT BUSINESSES ARE

UNFAIRLY ENDURING THESE FEES AND ALLOWS MERCHANTS TO ADD A SMALL “CONVENIENCE

FEE” TO A BANK CARD PURCHASE.

IMPLEMENTED BY THOUSANDS OF MASSACHUSETTS BUSINESSES AND TENS OF THOUSANDS

NATIONWIDE IT HAS BEEN PROVEN THAT CONSUMERS

READILY ACCEPT PAYING THE “CONVENIENCE FEE” IN EXCHANGE TO CONTINUE

USING THEIR BANK CARDS FOR PAYMENT.

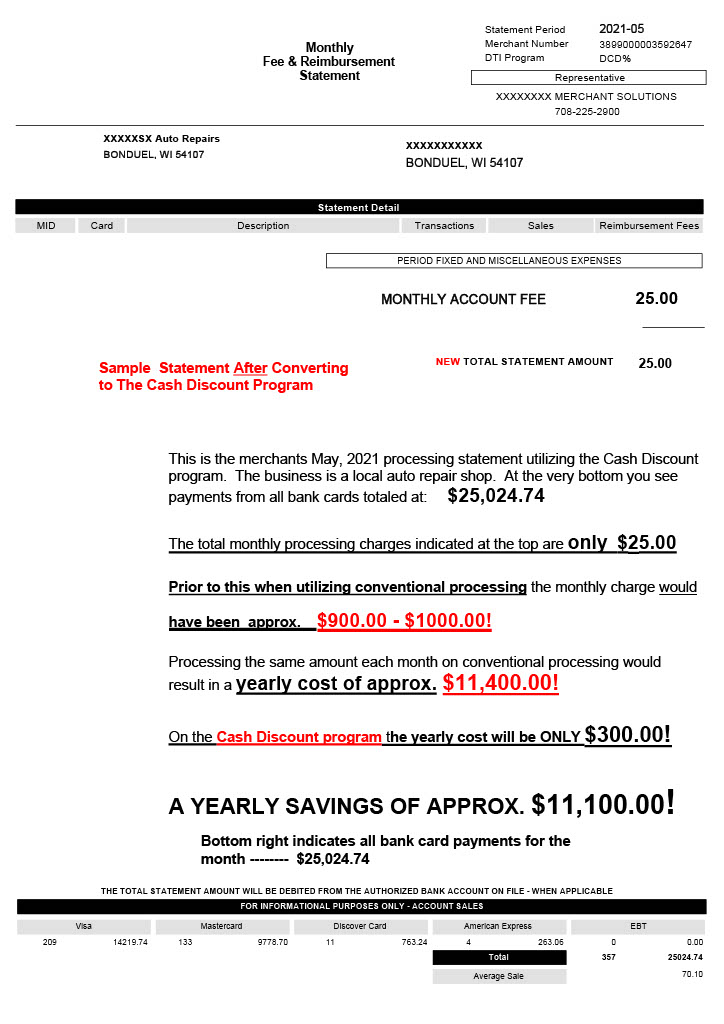

YOUR NEW PROCESSING RATE WILL NOW BE

0%!YOUR TOTAL MONTHLY PROCESSING COSTS WILL NOW BE ZERO!

HOW MUCH $$ CAN I SAVE YEARLY?

| Best Businesses For

The Cash Discount Program |

Yearly Savings With

The Cash Discount Program |

|

|

Auto - Truck Repair / Quick Lube Shops Car Wash Business Sporting Goods / Firearm Dealers Non-Chain Pizza / Sandwich Shops Family Restaurants Bakery / Cake Shops Dry Cleaners / Tailor Shops Computer Repair Hair Dresser / Nail Salons Men's Barber Local Grocery / Variety Store |

|

All These Monthly Fees Are

Eliminated!

Terminal Rental Fee

Statement

FeeOnline Access

Fee

Express Funding Fee

Authorization Fee

Transaction Fee

Interchange Fee

PCI Compliance Fee

ALL “B.S.” Junk Fees

Every

Day You Wait You Are Losing Money!

Call / Txt 617-510-9414

or

NOTE: If not interested in the cash discount program we guarantee we

can still save you money from your current processor. Let

us review your statements

VERY IMPORTANT

FREQUENTLY ASKED QUESTIONS

© 2021

William J. Mullen / Copyright Pending

The following "Frequently Asked

Questions" are original content and the sole property of William J.

Mullen. As such they are protected by the United States federal and

international copyright laws. It is illegal to copy or reproduce any

portion of this content. Violations are subject to statutory damages

and attorney fees.

Question: What

is the Cash Discount Program?

Answer:

First and foremost the most exciting change in the credit/card industry

resulting in significant profits for small businesses!

The Cash Discount Program was designed to help business owners to

LEGALLY avoid paying the ridiculously

high processing costs when accepting credit cards and especially

REWARDS CARDS that add another 2%, further eating into your profits!

(YES,

YOU

THE MERCHANT ARE PAYING THESE REWARDS POINTS!)

How does it work?

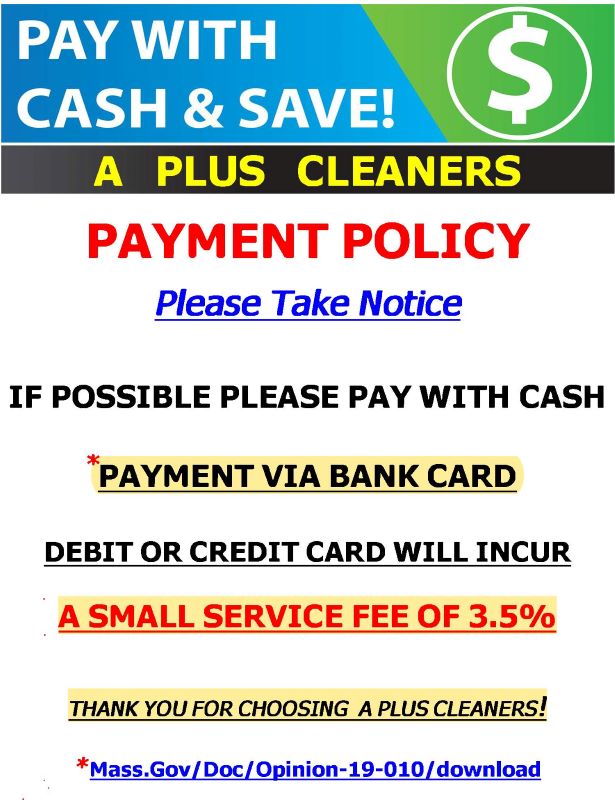

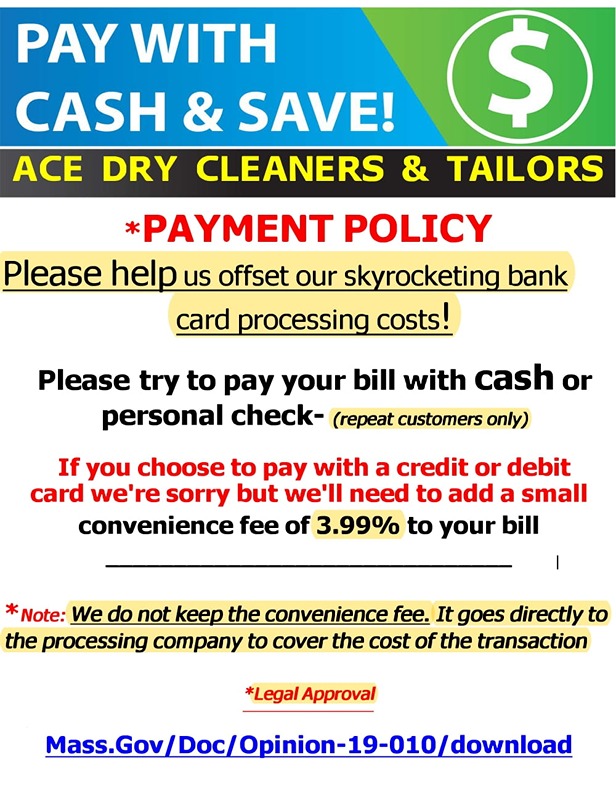

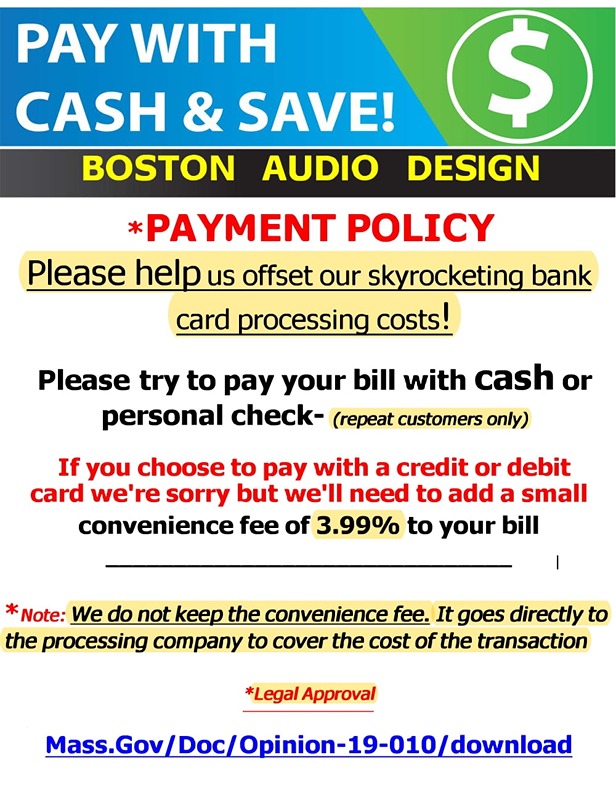

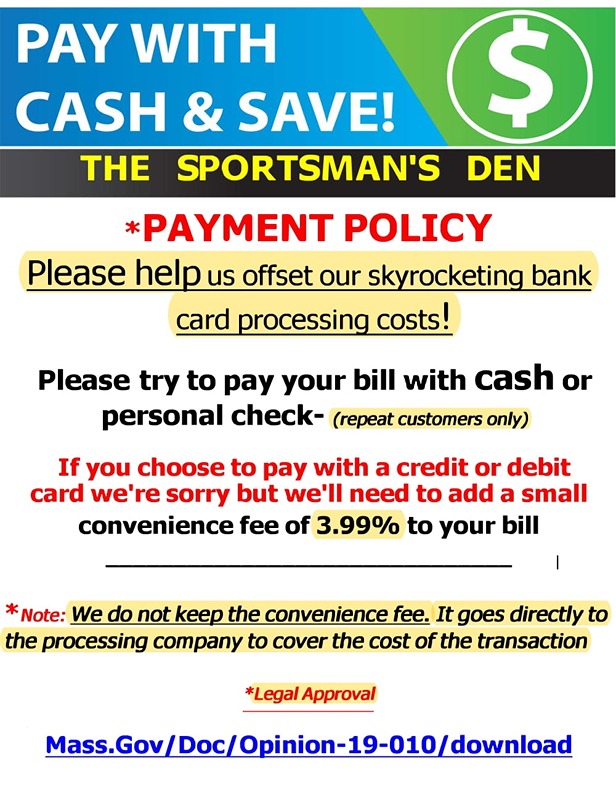

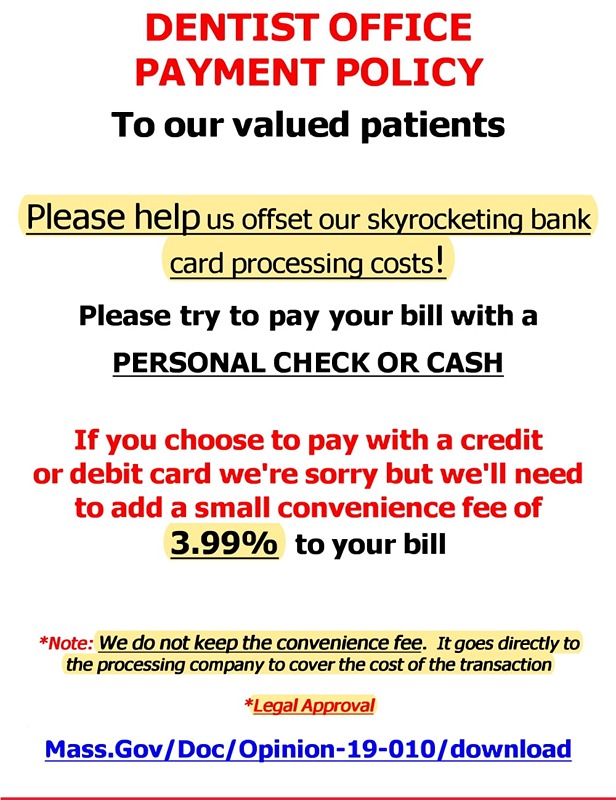

Posted signage politely asks your

customers if they can pay for their purchase with cash (or check)

to help

offset your skyrocketing bank card processing costs.

If however they choose

to pay with their bank card you’re sorry but you’ll need to add a small

convenience fee to their bill.

If they choose to pay with their bank card the small convenience fee

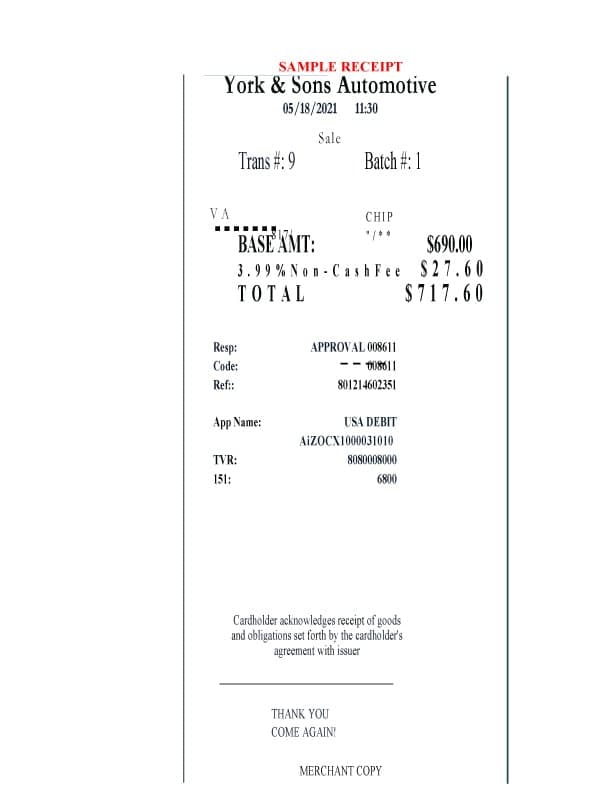

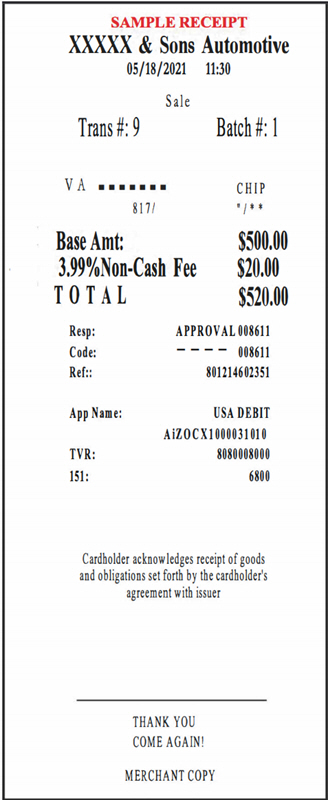

of 3.99% is automatically calculated by the proprietary "Cash

Discount" software loaded into the NEW TERMINAL we provide.

It does not get lumped into the total, rather it appears on their receipt

as a separate line item ( non-cash

fee ) and covers all your processing costs for this transaction.

At the close of business or when you "batch out" (usually automatically)

the terminal sends this fee to the processing company.

NOTE: This

non-cash fee is NOT deposited

into your account; rather it goes directly to the processor.

Example:

(click

here for multiple sample signs)

VERY IMPORTANT!

Cash discounting is NOT surcharging! Massachusetts

law describes surcharging as when at the point of sale a customer is

informed if S/he uses a credit card you will add a service fee. This

service fee is added DIRECTLY to the purchase price and is kept

by the merchant.

To be crystal clear the Cash Discount Program has three important elements

distinguishing it from surcharging.

1.

Conspicuous posted signage explaining the payment policy.

2.

The credit / debit receipt has a separate line itemizing the 3.99% "non-cash

fee."

It may sound or be construed as deceptive but there

is a distinct difference between surcharging and the cash discount program

and one that Visa, MasterCard and the courts have all agreed upon. It

is perfectly legal and being practiced in all 50 States.

Additionally any worries that customers will object have been

proven to be completely unfounded.

In businesses like

auto repair

over the years you have most assuredly posted a sign regarding your

hourly labor rate increasing:

To Our Valued Customers

As Of June 1st Our Hourly Labor Rate

Will Increase to $75.00

In doing so you did not take a

survey with your customers asking them in advance how they

would feel about you raising your hourly labor rate. You simply

came to the conclusion you needed to raise it and posted a notice.

Upon your customers reading it and realizing your labor rate increased

they did not challenge it or argue with you about it. Like everything

prices go up and your customers accepted

it and continued to do business with you.

Worries that your customers will object or challenge your new payment

policy will be NO DIFFERENT than when you raised your hourly rate.

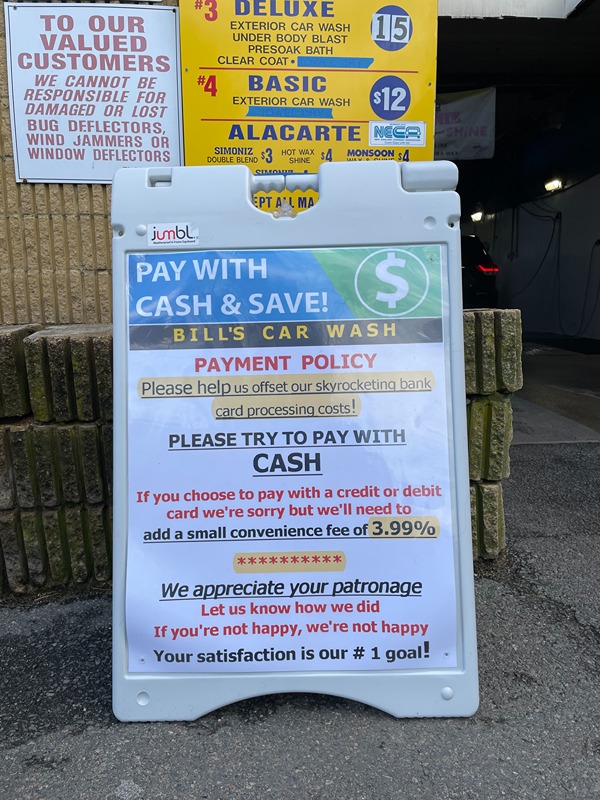

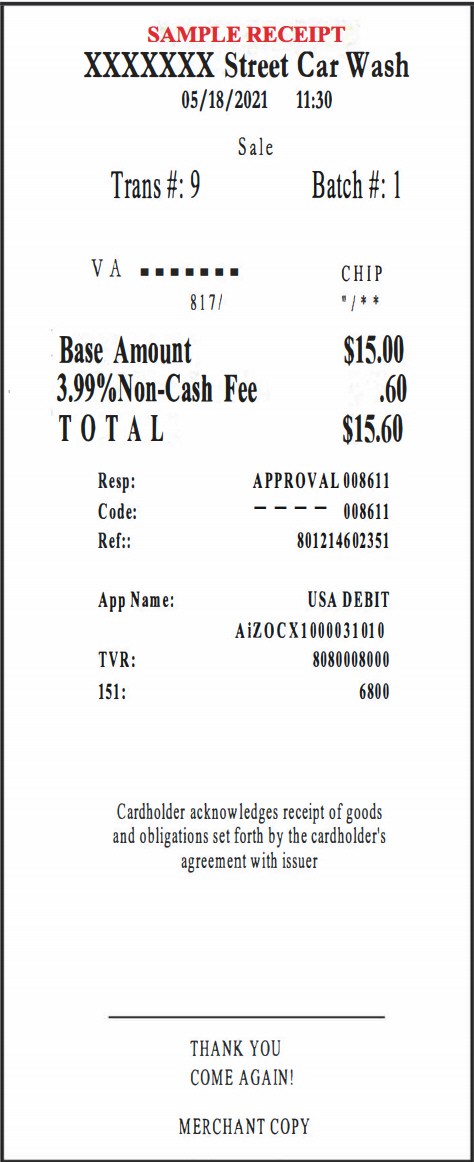

For small businesses, i.e.,

car washes,

quick

(Auto)

lube shops,

variety stores, pizza

shops,

bakeries, dry cleaners, hair salons etc., where the purchase might

be $15 - $50 customers DON'T EVEN BLINK AN EYE"! The

"non-cash fee" is totally insignificant.

(click

here for sample car wash sign)

Example: At a

car wash

where the cost is

$15.00

the non-cash fee” is

ONLY 60 cents.

(click

here for sample receipt

At quick lube shops

where the cost typically averages around $40.00, the “non-cash fee”

would

only be $1.60.

Consumers visit these

quick lube shops

because of the convenience of not having to make an appointment and

being on their way in less than 15 minutes,

VS

waiting a week for an appointment with their local mechanic, not to

mention leaving your vehicle there all day!

In both these examples the “non-cash fee” is totally insignificant

and if they’re using a rewards card

their "mindset" is; "no big deal, I'm getting my points anyway"…….

Only this time YOU the merchant are not paying the processing fee and

especially the extra 2% in points!

In fact, a simple Google Search using the term: "Cash

Discount Program" will

bring up dozens of processors offering the program IN

ALL 50 STATES

Question: I understand it is legal but could I have a simple comparison: Surcharging

VS Cash Discount Program?

Answer:

Surcharging

is when a customer is informed

ONLY

at the point of the sale

that a service fee is being added because they are using a bank card.

The merchant then simply ads a percentage to the purchase price to

cover his credit card processing cost.

A.

There is NO signage anywhere to inform customers of your payment

policy.

B.

The added fee is NOT itemized on the receipt; rather it is just

added onto the total price.

C.

The merchant KEEPS this added fee.

VS

THE CASH DISCOUNT PROGRAM

A.

You've informed your customers of your payment policy

with proper signage conspicuously posted for all to see.

I.e.,

signage:

"ALL

repair services and parts include a cash discount incentive of 3.99%,

so you are saving instantly if you are paying with cash. If

you choose to pay with a credit

or debit card you will not be taking advantage of the

3.99% cash discount and the difference

will be added to your purchase".

B.

If the customer chooses to pay with a bank card

it

appears as a separate line item on the receipt.

It is indicated as a Non-Cash fee.

Question: What

businesses reap the most benefits from the cash discount program?

Answer:

Auto repair, auto body and especially sporting good retailers that are

also selling firearms are businesses where consumers are

most likely to pay a significant bill with their rewards

card which greatly erodes profit margins for the business owner.

If your business is Auto

Body you could be getting screwed BIG TIME as many customers

today are now depositing

their insurance checks and paying for their repair with

their rewards card!

For smaller businesses like car

washes, dry

cleaners, quick

lube shops, pizza

/ sandwich shops, family

owned variety stores, liquor

stores, hair

salons, barber

shops, tanning

salons, bakeries, and print

shops even though your sales may be much smaller, processing

fees can also cost the owners thousands of dollars each year.

Question: What

are "rewards" cards?

Answer: Rewards

cards are credit cards that "reward" the person using the card with

"points" for air or travel miles or actual CASH BACK. Who hasn't

seen Samuel Jackson asking, "What's in your wallet?"

Today more and more customers are paying with rewards cards from minor

purchases of gas, fast food, dry cleaners, hair dressers etc., and YOU the

business owner are paying that extra 1.5

– 2.0% in

their reward points. Keep in mind this is in addition to your standard

processing percentage, further eating into your profits!

If your business is Auto Body you could be getting screwed BIG TIME as many customers today are now depositing their insurance checks and paying for their repair with their rewards card!

TO MAKE MATTERS WORSE REWARDS CARDS ARE NOT ANY DIFFERENT FROM STANDARD CREDIT CARDS AND ONLY AFTER REVIEWING YOUR MONTHLY STATEMENT WILL YOU DISCOVER THAT PAYMENT CAUSED YOU TO LOSE AN ADDITIONAL 2% OF YOUR PROFIT!

Worse still, it is predicted that competition will cause rewards cards

to increase

to 3-5% in

the very near future. Accepting credit cards was originally a vehicle

to attract more business and a convenience for your customers. Today

however it has "morphed" into a nightmare "bleeding" your profits.

The

Cash Discount Program is your chance to FIGHT BACK!

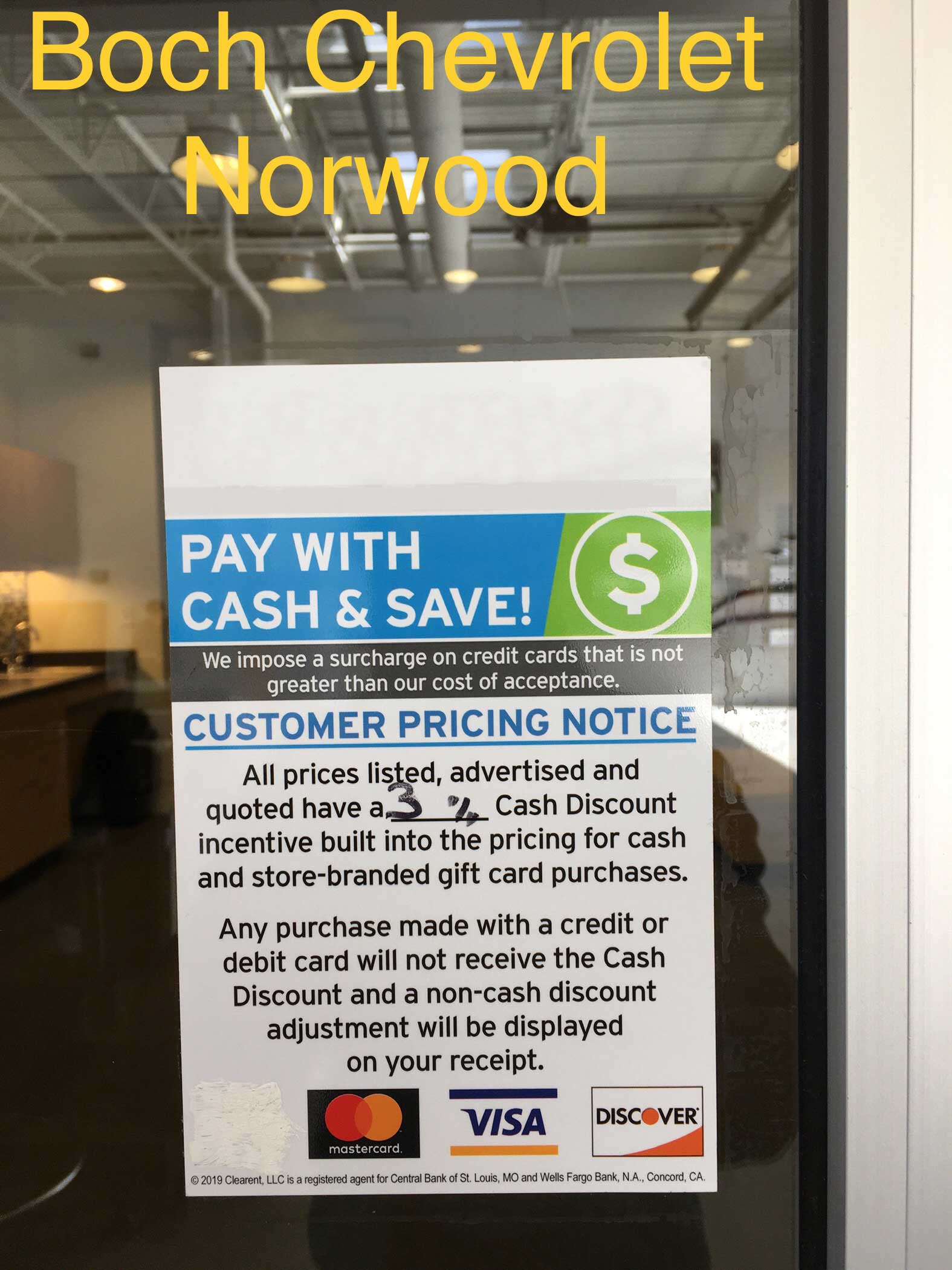

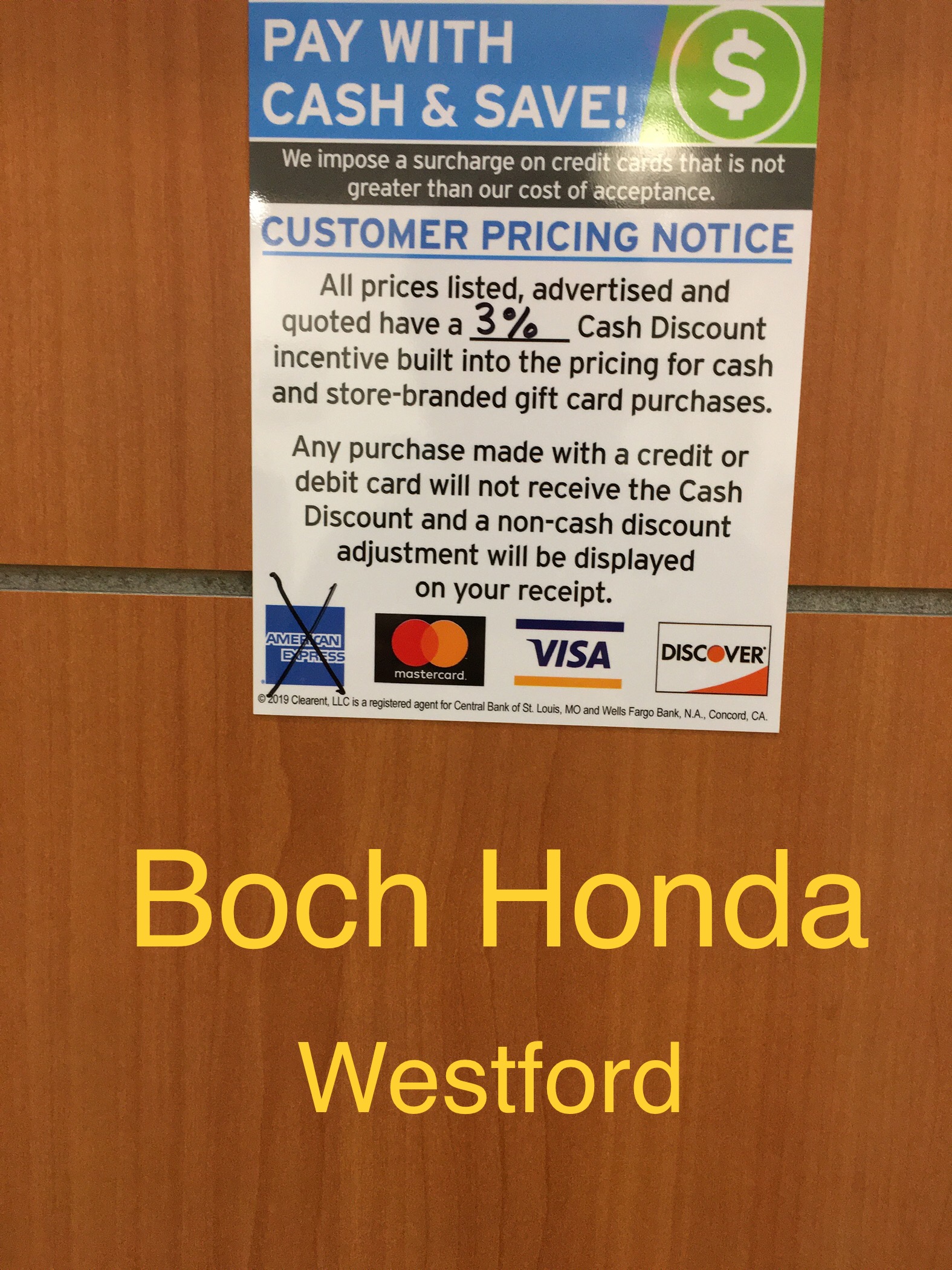

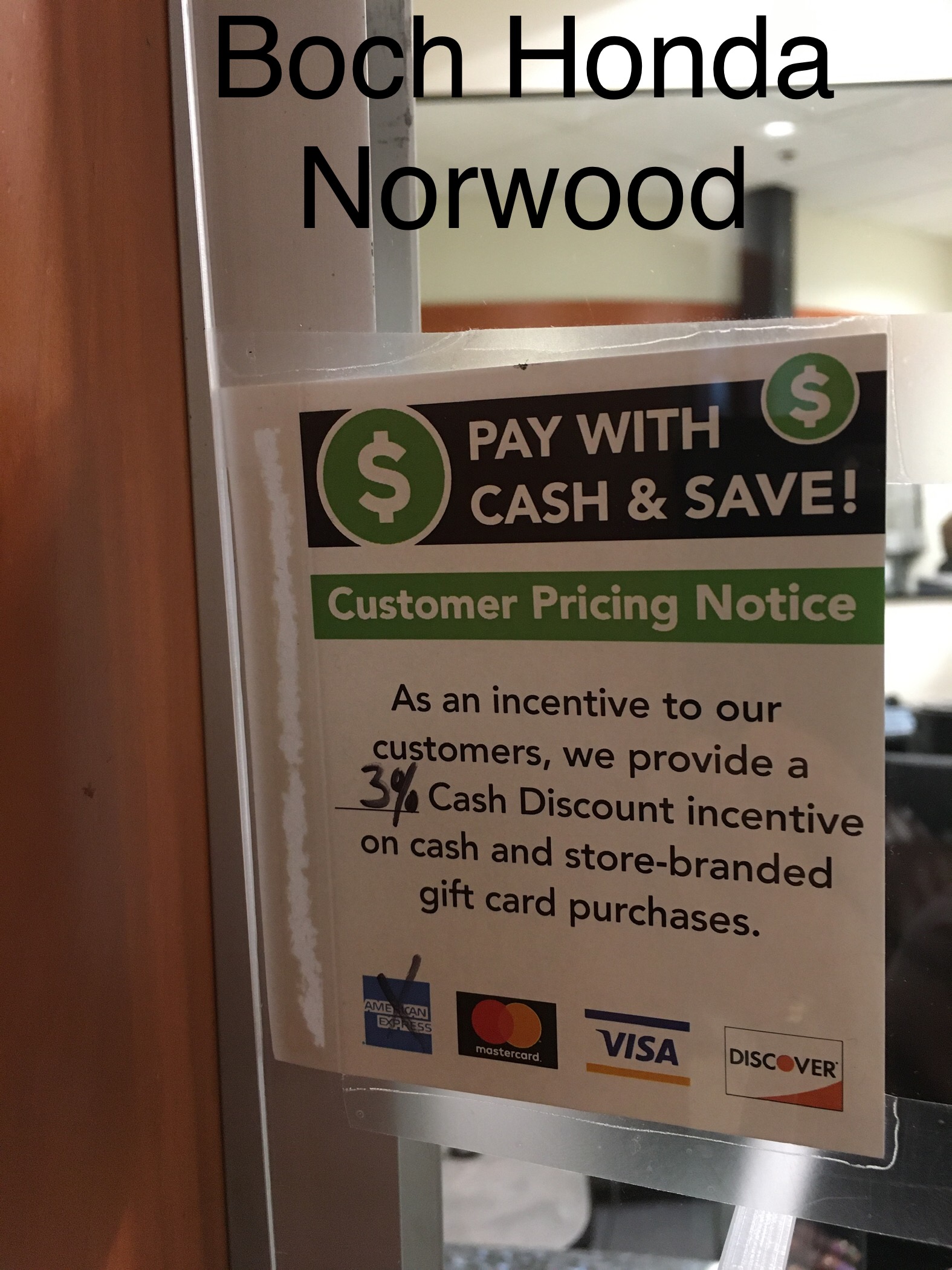

Question: What

well known AUTO business in

Answer:

The Boch Automobile dealerships headquartered in

Following a consumer complaint the

Allowing

Boch dealerships

to collect a processing fee

through a 3rd party processor.

"The position of the division is that the processing fee

is

not in violation

of the

(surcharging)

law;

G.L.c I40D, Sec. 28A"

(The letter is crystal clear that Boch is

not surcharging,

rather has implemented a

Cash Discount Program!

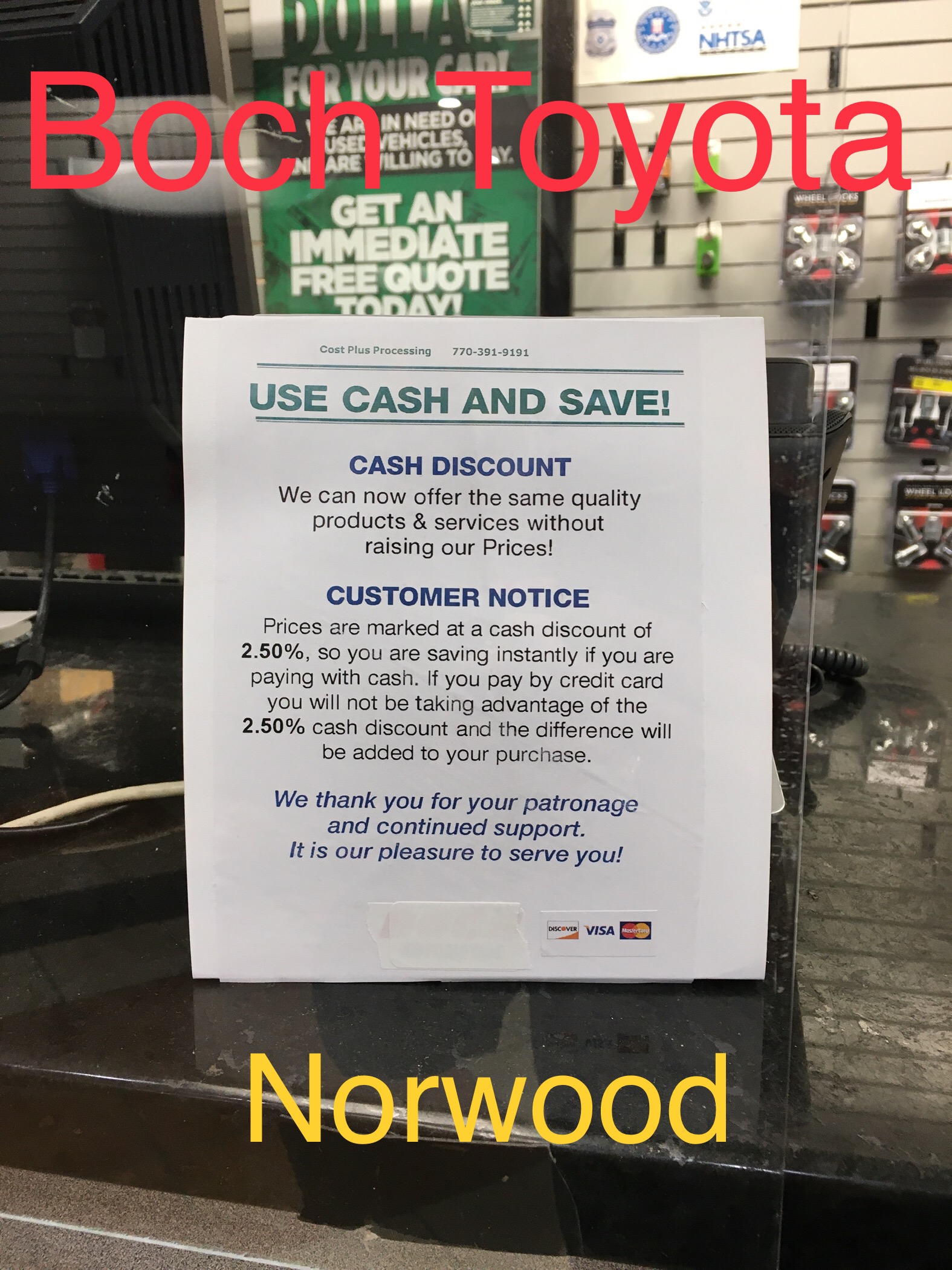

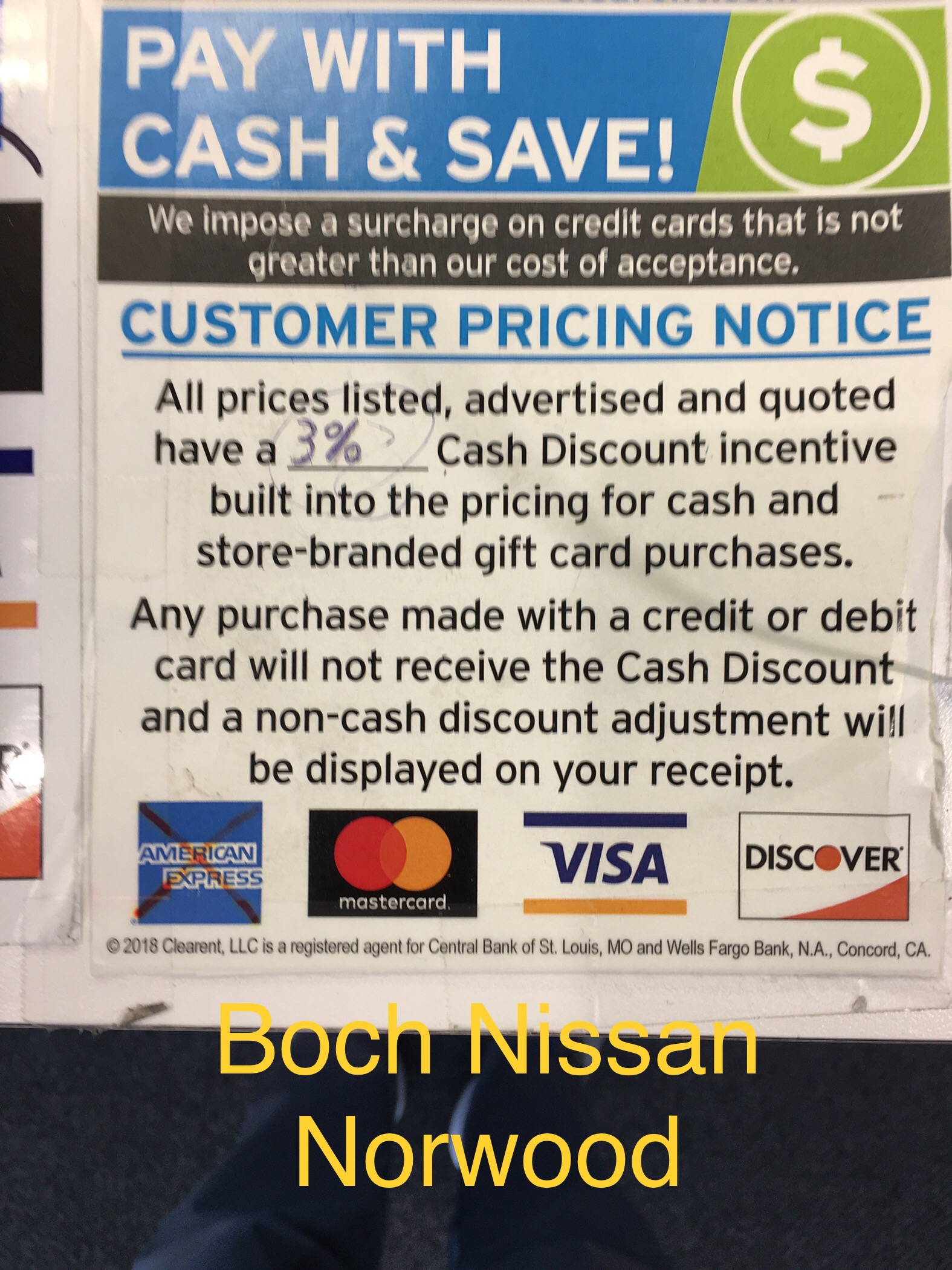

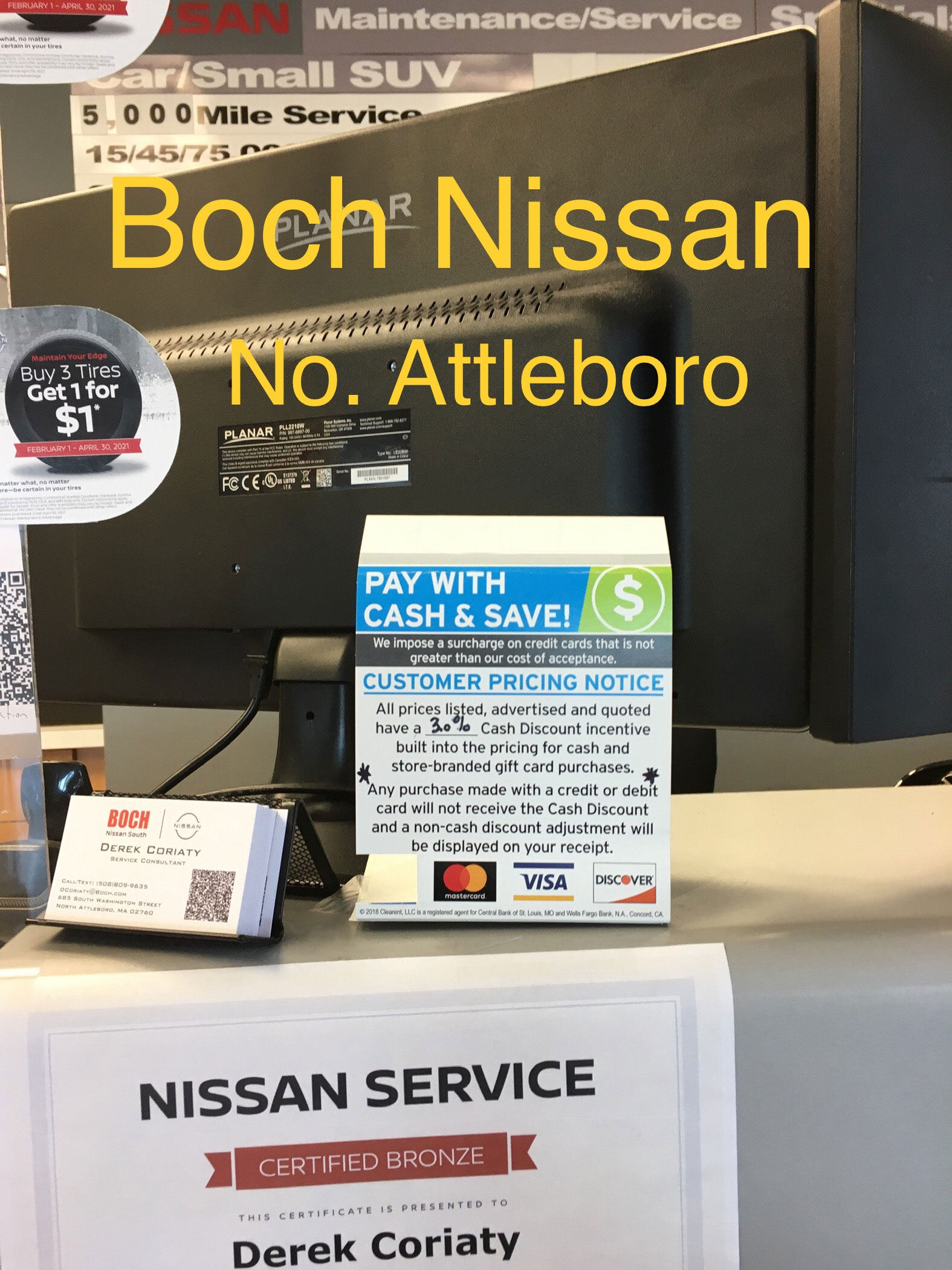

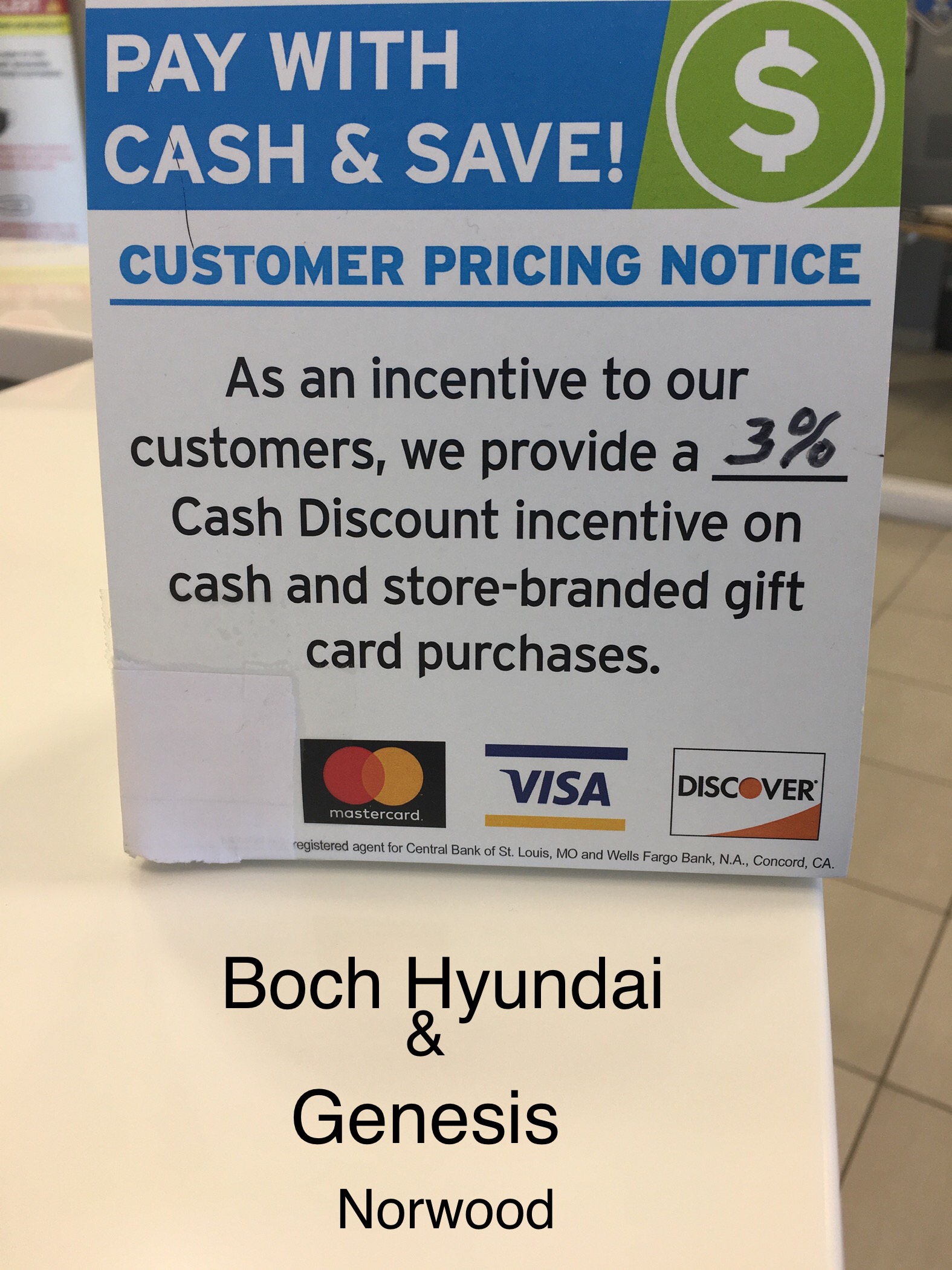

The Cash Discount Program is being utilized at:

THESE ARE THE INDIVIDUAL

SIGNS POSTED IN EACH DEALERSHIP

|

|

|

|

|

|

|

|

To reiterate: This

decision by the office of consumer affairs

unequivocally

defines the Cash Discount program as "NOT

IN VIOLATION OF THE SURCHARGING LAW" and

"clears the path"

for

any business in

The original letter from the office of consumer

affairs can be read here.

https://www.mass.gov/doc/opinion-19-010/download

Read the article in the June 2021 issue of New

England Automotive Report

“Relief From Fees; Overcoming The Credit Card Crunch”

The program literally ads

thousands to your yearly profit!

Every Day You Wait You Are Losing Money!

Question: Will

I lose my customers? Will they complain?

Answer: NO!

….But to be honest when the cash discount program was first implemented

this naturally was the major concern.

As it turns out it is

actually the easiest change

you've ever made to your business to

increase

your profits!

Consider this: Today's consumers have grown accustomed

to businesses NOT accepting AMEX.

People actually often ask "do you accept American Express?"

They also have experienced fees when using their

bank cards to pay utility bills,

auto excise bills,

hospital bills and even when

renewing their license at the registry

of motor vehicles.

The trend of adding a small convenience fee on

bank card purchases is

becoming common place.

Adding a convenience fee to your goods or services is just another extension

of this common practice.

Furthermore, two separate nationwide studies involving

2,000 small businesses, many of them auto repair shops that

have high ticket sales report absolutely

no loss or complaints from customers!

********

Question:

What about a customer that challenges the fee?

Answer: Properly

placed signage with POLITE language

asking your customers to HELP YOU

is CLEARLY the most important first step in avoiding any challenge or

discussion.

Despite this we all know however there is always "that

person" that wants to challenge everything in life. This person

will dispute the convenience fee of only 4

cents on a bottle of juice.

Solution:

"I

understand we didn't have this policy the last time you were in. I'll

refund the convenience fee this time but if you remember next time in

just pay cash”

Handled politely in this manner the next time

this customer returns to your business

s/he will more than likely just pay

with their bank card never mentioning the fee again.

********

AUTO BODY / REPAIR SHOP

IF YOU'RE AN AUTO BODY OR REPAIR SHOP YOUR CHARGES ARE SIGNIFICANTLY

HIGHER THAN A PIZZA SHOP AND TODAY THE TREND IS FOR CUSTOMERS TO DEPOSIT

THEIR INSURANCE CHECK AND THEN PAY WITH THEIR REWARDS CARD!

Again we cannot stress enough the importance of displaying very clear

signage explaining your payment policy that wards off any discussion

or disagreements when they finally arrive back to pick-up their vehicle.

You might say: "Mike,

we don't inflate our bill like most shops to cover our credit card fees"

"These fees especially when people pay with a rewards card take a huge

bite from our profit"

Or

you might say:

"Mike, without loyal customers like you my business would not be successful;

I'll give you a break on the labor charge that will cover most if not

all of the convenience fee"

Your customers

To further give you a total comfort level that

you won't get any objections from your customers we've also included testimonial

videos from businesses across the U.S.

Find these testimonials in our video at the top of the page

Question:

How do I know if a customer is presenting me with a standard credit

card or rewards card that adds another 2% to my processing fee and further

erodes my profit?

Answer:

You DON'T! You

have NO WAY of knowing if your customer is using a rewards card, thus ADDING

ANOTHER 2% to the

processing fee!

Question:

Is this a brand new program?

Answer: NO, in

fact it has been active in the

Question: Why

doesn't my existing processor switch me over to the cash discount program?

Answer: The

answer to this is simple: THEY

WILL LOSE MONEY!

Unknown to merchants, the banks offer generous incentives to processors

to maintain your account. The longer they maintain it their

monthly (profit) percentage

of all the fees applied to your account increases. They also

receive a yearly bonus based on your processing volume.

To switch you over to the cash discount program would require them to

create a brand new account for your business. Doing so will

cancel out their monthly and yearly residual payments. It

will take years for them to recoup the profit margin they had with your

original account.

A typical response when a merchant inquires to their present processor

about the cash discount program is that it will create a "ton" of paperwork

for you, something they know you

would not welcome. Another excuse is to falsely

claim your customers will object to it.

As a last resort they might falsely claim it is surcharging or illegal.

The Massachusetts Division of Consumer Affairs-Division of Banks has ruled that adding a convenience fee in conjunction with following the parameters of their decision is 100% legal and is "NOT IN VIOLATION OF THE SURCHARGING LAW."

Question: Why

aren't more businesses implementing this program?

Answer:

1. Fear

of losing customers. (Nationwide this has proven to be Non-Existent)

2.

Having heard from "Know-it-alls" that do not know the facts,

mistakenly believing it to be either illegal or surcharging.

3. MOSTLY

Just too busy to set aside the time to meet with the representative

4. Similar

to most people in all "walks of life", simply resist

changes despite the improvements, benefits or savings it can offer us

5. Mistakenly believe it to be a "huge"

project and too complicated to switch from their present processor

6. Have not heard about the cash discount

program and the savings it will offer

When it comes to your monthly statement most owners

literally "give up" trying to decipher all the added fees and

just accept it as the "cost of doing business."

Chances are every month you are being charged (losing) processing

fees of $600.00 - $1,500.00 on repairs paid with credit

cards and rewards cards!

The Cash Discount Program is legal,

you won't lose any customers,

switching over is quick and easy and you can save THOUSANDS

every year!

This is your chance to FIGHT

BACK against

a system that has been "bleeding" your profits for years.

YOUR NEW PROCESSING RATE WILL NOW BE 0%

Question: Can

I learn in advance how much

$$

I can expect to save every month before moving forward with this program?

Answer: YES.

Click Here For Savings Chart

Question: Can

I switch back to conventional processing if I desire?

Answer: To

date we have not had this request but YES.

If

after 30 days you don't think our program is right for your business

we'll switch you back to traditional processing at the lowest rate possible

which we guarantee

will be less than your original processor.

The bottom line is you'll

still save money!

Either way, you can't lose. It's a WIN, WIN for you!

Question: Will

the merchant processing company offer support or assist in any possible

problems I might have?

Answer: Yes.

Customer support is always available to assist with any technical questions

and if necessary your

customer representative is local and can come directly to your business.

You will have his direct phone number.

Question: What

are the steps to implement the cash discount program?

Answer: Call,

text or e-mail to schedule an appointment. Our

rep will come to your business or home seven days a week at your convenience.

A 15-30 minute meeting should be all that is required.

The transition will be seamless with us taking

care of all the details, including contacting your existing processor

and handling the return of your existing terminal(s) IF necessary.

In most cases your terminal(s) is outdated and

your processor has amortized its expense will all the fees you've been

charged and will never contact you for the return.

You don't have to change any of your prices.

Question: Can

I still participate if I only use a credit card swiper on my phone?

Answer: YES. We

will supply you with a new card swiper(s) programmed with the cash discount

software.

Question: What

is an EMV terminal?

Answer: EMV

stands for Euro pay, MasterCard and Visa and is a secure method of processing

credit or debit cards. It involves a complex authentication which

substantially reduces the chance of a transaction using a stolen or

copied credit card.

Question: Why

do I need an EMV terminal?

Answer: As

of October, 2015 all businesses are required to be using

an EMV-compliant chip reading terminal.

IF YOU ARE CURRENTLY USING AN OLD NON-COMPLIANT TERMINAL

You the merchant and not the issuing bank are liable for the fraudulent

transaction. This means you'll be reimbursing the charge, never mind

losing the cost of the product or service.

Question: I

have a high average sale amount and the 3.99% might be significant and

viewed as being too high for my customers. Could my service fee

be calculated at a lower rate?

Answer: YES.

A lower rate is available for high volume processors such as new car

dealers service departments.

Question: Who

is ZeroCreditCardFees.Com ?

Answer: ZeroCreditCardFees.Com and its agents are

merchant service providers that match businesses with a processing company

(MSP) best suited for their needs.

The processing company provides the equipment and

software necessary to process payments through traditional terminals.

Their proprietary software is exclusively designed to process payments

for the cash discount program.

© 2015-2023 ZeroCreditFees.Com